Market Dynamics: What’s Fueling the Rise of Financial Accounting Outsourcing in the USA?

The FAO market is expanding as firms move away from in-house finance, driven by cost concerns, compliance needs, and automation.

“Financial accounting outsourcing is now a necessity, not just an option, Businesses must adapt to evolving regulations while optimizing efficiency and compliance. Partnering with the right provider ensures financial stability and operational focus” says Ajay Mehta CEO at IBN Technologies.

Accounting Hassles? Let the Experts Handle It for You! Start Today!

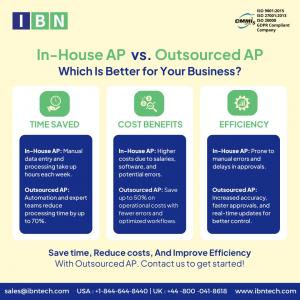

Corporations across industries are reassessing their financial management models as rising costs and regulatory complexities make in-house accounting less viable. Payroll processing, expense tracking, tax compliance, and financial reporting require expertise that many businesses lack internally. Outsourcing these functions allows companies to tap into a global network of financial professionals, ensuring accuracy and compliance while reducing operational costs. The shift toward financial accounting outsourcing services is driven by more than financial savings; businesses are also seeking to enhance efficiency and reduce risks associated with regulatory non-compliance and financial mismanagement.

Technological advancements are reshaping the FAO sector, equipping businesses with tools that improve financial transparency and streamline accounting processes. Automated expense tracking systems now integrate directly with corporate accounts, reducing manual errors and improving financial oversight. Billing and invoicing platforms ensure seamless cash flow management, while compliance management software provides real-time tracking of regulatory obligations. These digital solutions are making financial accounting outsourcing a more attractive option for businesses aiming to modernize their financial operations and mitigate risks.

Outsourced accounting services are also capitalizing on predictive analytics to enhance financial planning. Companies that leverage outsourced financial forecasting tools can gain valuable insights into revenue trends, budgeting strategies, and risk assessments. Tax compliance, another critical area, is becoming more automated, reducing human errors and ensuring adherence to international tax frameworks. With regulations constantly evolving, businesses increasingly rely on financial accounting outsourcing services firms to manage tax-related complexities and integrate real-time compliance updates.

Maintaining steady cash flow remains a primary challenge for businesses, prompting a surge in outsourced cash flow management services. Financial service providers offer businesses access to sophisticated forecasting tools that analyze spending patterns and revenue cycles in real time. By outsourcing cash flow monitoring, companies can avoid liquidity shortfalls, optimize working capital, and make more informed financial decisions. Reliable cash flow forecasting has become essential in helping businesses navigate economic uncertainties and sustain financial stability.

Prevent Cash Shortfalls—Optimize Your Financial Strategy Now!

https://www.ibntech.com/pricing/?pr=EIN

The appeal of financial accounting outsourcing services extends beyond cost reduction, as companies recognize the operational advantages of scalability and flexibility. Outsourcing firms provide industry-specific financial expertise while allowing businesses to scale their operations without the challenges of hiring and training internal teams. The integration of automation in outsourced financial services has also helped businesses minimize errors, improve accuracy, and enhance overall financial performance. This shift underscores a growing trend where companies prioritize efficiency and regulatory compliance by adopting FAO solutions.

“As businesses confront growing financial complexities, demand for outsourcing solutions that combine process efficiency with compliance expertise continues to rise,” Mehta added. “Companies that integrate outsourcing into their financial strategies not only reduce administrative burdens but also gain a competitive advantage by improving financial agility and decision-making.”

Industries such as healthcare, retail, manufacturing, and technology are seeing an increasing reliance on outsourced financial services as regulations become more stringent. The need for secure and compliant financial management solutions has pushed outsourcing firms to invest heavily in cybersecurity and fraud prevention measures. Additionally, innovations such as blockchain-based financial solutions and cloud-integrated accounting platforms are expected to shape the future of outsourced financial services, offering greater transparency and security in financial transactions.

The FAO market’s projected growth beyond USD 110 billion by 2033 highlights a significant shift in corporate financial strategies. Companies that leverage outsourcing will be better equipped to navigate regulatory challenges, streamline their accounting processes, and drive long-term financial sustainability. As financial accounting outsourcing becomes a core component of modern financial management, businesses that proactively integrate these solutions stand to gain a competitive edge in an increasingly complex economic landscape.

Source

Outsourced Finance and Accounting USA | IBN Technologies

https://www.ibntech.com/blog/outsourcing-finance-and-accounting-impact-business-strategy/?pr=EIN

Explore More Services

1) USA Bookkeeping Services

https://www.ibntech.com/bookkeeping-services-usa/?pr=EIN

2) Payroll Processing Services

https://www.ibntech.com/payroll-processing/?pr=EIN

3) Tax Filing in the United States Guide

https://www.ibntech.com/article/us-tax-filing-2025-guide/?pr=EIN

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

sales@ibntech.com

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Business & Economy

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release